How Global Water Treatment Growth Drives Valve Demand

Introduction

Water is one of the world’s most valuable yet limited resources. With rapid population growth, accelerating urbanization, and the increasing effects of climate change, global water scarcity has become a critical issue. At the same time, stricter environmental policies and sustainability goals are forcing governments and industries to improve water management practices. This combination of necessity and regulation is fueling massive investments in water treatment infrastructure — from municipal wastewater plants to industrial purification systems.

Amid this transformation, valves have emerged as vital components that ensure the safe, efficient, and precise control of water flow at every stage of treatment. The global expansion of the water treatment industry is not only increasing the number of valves installed worldwide but is also driving the development of smarter, more durable, and energy-efficient valve technologies. Understanding this connection reveals how market growth in water treatment directly stimulates innovation and demand across the valve manufacturing sector.

The Expanding Global Water Treatment Industry

The global water treatment industry has entered a sustained growth phase, propelled by a mix of economic, environmental, and technological factors. Population growth and industrial expansion are pushing global water consumption to record levels. Simultaneously, rising water pollution and declining freshwater reserves are creating urgent demand for treatment and reuse systems. Governments are responding with stricter regulations and larger infrastructure budgets, while private industries seek cleaner and more sustainable operations.

According to industry data, the global market for water treatment valves was valued at around USD 10.8 billion in 2022 and is expected to surpass USD 16 billion by 2030, maintaining a compound annual growth rate (CAGR) of about 5%. Some forecasts even suggest the market could reach USD 21 billion by 2035. These figures reflect a fundamental reality: every new or upgraded water treatment plant requires thousands of valves to regulate flow, manage pressure, and protect pipelines.

This growth is visible in multiple sectors. Municipal water utilities are upgrading outdated infrastructure to meet modern efficiency and safety standards. Industrial players in sectors such as energy, pharmaceuticals, food processing, and semiconductors are investing in high-quality water systems to meet product and process requirements. Meanwhile, water reuse, desalination, and smart water management are expanding rapidly in regions like the Middle East, Southeast Asia, and North America. Each of these projects generates steady and diverse demand for valve technologies adapted to specific environments and regulations.

Valves: The Core of Water Treatment Operations

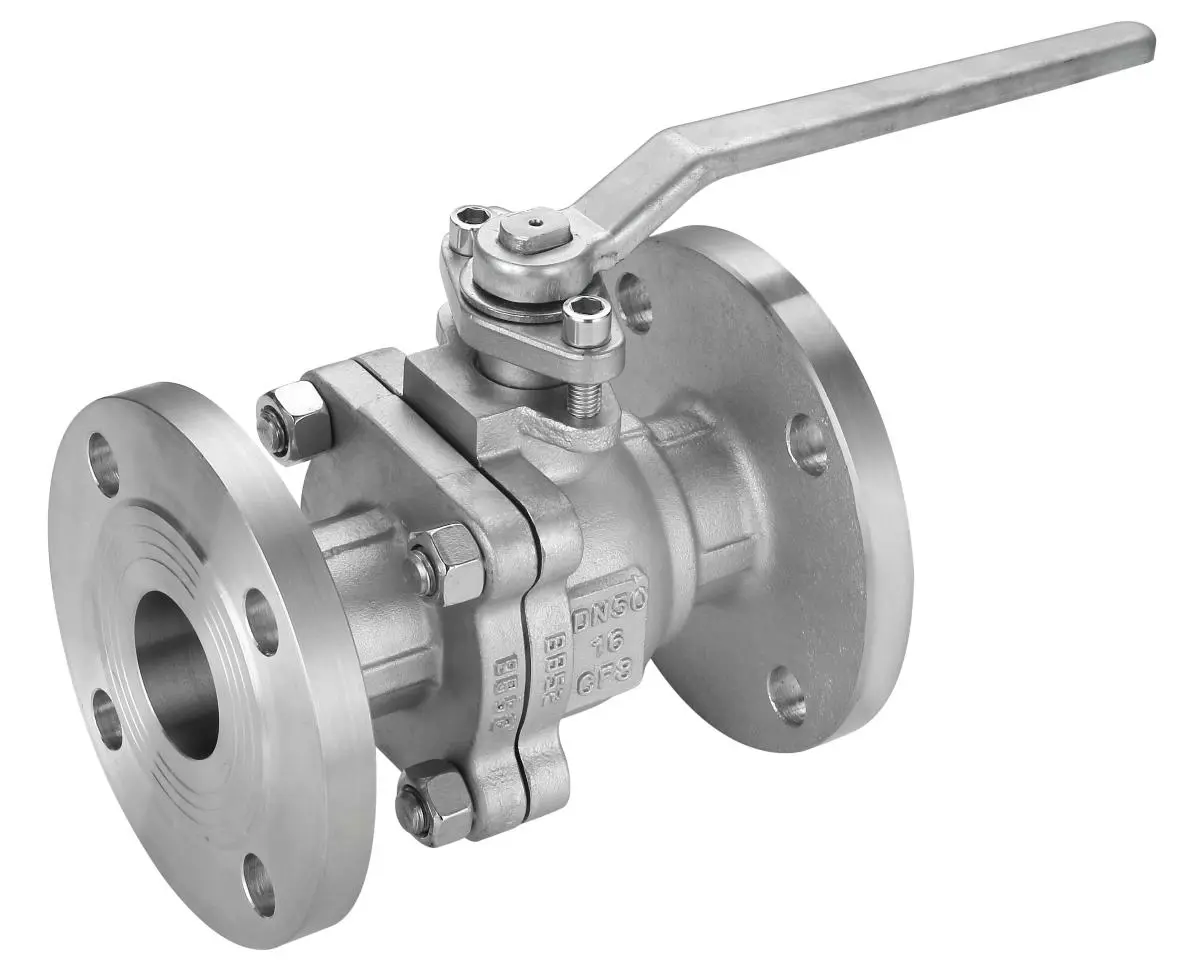

Valves are the unsung heroes of water management systems. They control, isolate, and regulate the flow of water and chemicals through networks of pipelines, pumps, and filters. Without them, even the most advanced water treatment facilities would be unable to operate safely or efficiently. In municipal networks, gate valves and Butterfly Valves control water distribution and prevent backflow. In industrial plants, control valves adjust flow and pressure to protect membranes, filters, and reactors.

Different treatment stages require specialized valve designs and materials. For example, the filtration stage relies on valves capable of rapid opening and closing during backwash cycles. Chemical dosing systems demand high-precision valves that resist corrosion from chlorine and acids. Disinfection and desalination processes often use high-pressure valves built from duplex stainless steel or superalloy materials to withstand harsh saline or chemical conditions.

As a result, the valve industry has evolved far beyond simple mechanical devices. Modern treatment systems increasingly depend on automated and intelligent valve solutions. These include electrically or pneumatically actuated valves equipped with sensors that monitor parameters such as pressure, temperature, and flow rate. Connected to control networks like SCADA or IoT platforms, these smart valves can transmit data, detect anomalies, and even initiate self-adjustments — improving operational stability while reducing maintenance costs.

This technological evolution reflects a major shift: valves are no longer just passive components. They are now integral to optimizing efficiency, ensuring safety, and enabling predictive maintenance in complex water treatment environments.

How Water Treatment Growth Translates into Valve Demand

The rapid development of the global water treatment sector stimulates valve demand in several interconnected ways.

1.Expansion of Infrastructure

Each new treatment plant, pipeline, and distribution network requires valves for flow control, safety isolation, and system balancing. Large-scale municipal wastewater facilities can include thousands of valves, ranging from small control units to massive Butterfly Valves for main pipelines. The ongoing expansion of water infrastructure in Asia, Africa, and Latin America, alongside modernization in Europe and North America, ensures long-term and geographically diverse demand.

2.Increasing Technical Requirements

As environmental standards tighten and treatment processes become more complex, the specifications for valves grow more demanding. Operators now require valves that offer higher precision, lower leakage rates, and improved corrosion resistance. This drives investment in advanced sealing technologies, composite materials, and surface coatings that extend service life even in harsh environments. In short, the quality threshold for valves used in modern water treatment has risen significantly.

3.Automation and Smart Water Systems

Digital transformation is reshaping water treatment operations worldwide. The adoption of remote monitoring, AI-driven analytics, and IoT connectivity has made intelligent control valves a new standard. These smart valves provide real-time data for predictive maintenance, helping utilities reduce downtime and energy consumption. This convergence of automation and sustainability has made electrically actuated and sensor-enabled valves one of the fastest-growing segments in the market.

4.Maintenance and Retrofit Demand

Aging infrastructure in developed economies also contributes to rising valve demand. Many treatment plants built decades ago require extensive upgrades or replacements to meet current safety and efficiency standards. Replacing outdated manual valves with modern automated models improves system reliability and operational control, generating steady aftermarket opportunities for valve manufacturers and exporters.

Emerging Technologies and Market Trends

The valve industry’s evolution closely mirrors technological progress in water treatment. Over the next decade, several trends are expected to reshape the competitive landscape and redefine customer expectations.

1.Smart and Connected Valves

The integration of digital sensors and wireless communication is transforming valves into intelligent nodes within broader monitoring systems. These smart valves can detect abnormal pressure fluctuations, measure flow rates in real time, and communicate data to central platforms. Combined with AI-based analytics, they enable early fault detection and self-optimization, reducing maintenance costs and improving safety across water treatment facilities.

2.Advanced Materials and Corrosion Resistance

Harsh chemical environments — such as those in desalination and wastewater treatment — demand materials that can resist corrosion and abrasion. Manufacturers are increasingly adopting duplex stainless steel, titanium alloys, and high-grade polymers to extend valve longevity. Protective coatings and composite structures are also being used to reduce weight and energy consumption while maintaining strength and durability.

3.Sustainability and Energy Efficiency

Energy efficiency has become a decisive factor in valve design. Modern actuators consume less power, while streamlined valve geometries minimize flow resistance. Low-leakage and zero-emission designs help utilities conserve water and meet environmental targets. Moreover, the use of recyclable materials and eco-friendly manufacturing processes is enhancing the sustainability profile of valve products.

4.Modular and Standardized Solutions

Project developers are increasingly demanding modular valve assemblies that can be quickly integrated into prefabricated or containerized water treatment systems. Standardized interfaces and compact designs simplify installation and maintenance, reducing downtime and project costs. This trend aligns with the rise of decentralized water treatment units that serve remote communities or industrial clusters.

5.Regional Customization and Localization

Because water composition, temperature, and regulations vary across regions, localization has become a competitive advantage. Manufacturers are setting up regional service centers and forming partnerships with local distributors to provide faster support. Compliance with regional certifications — such as WRAS, NSF, or CE — also enhances credibility and market access.

Market Outlook and Strategic Insights

Global analysts forecast that the water and wastewater valve market will maintain a healthy growth rate of 4–6% annually through 2030. Within the broader Industrial Valve sector, which could exceed USD 100 billion by the end of the decade, water treatment remains one of the most resilient and dynamic segments. The drivers behind this trend — population growth, stricter environmental regulation, infrastructure investment, and digitalization — are long-term and unlikely to reverse.

At the same time, competition within the valve market is intensifying. Manufacturers face challenges such as volatile raw material prices, extended project timelines, and high customer expectations for customization. Sustainability has also become a differentiator; buyers increasingly prefer suppliers that offer eco-friendly production methods and transparent sourcing practices. To thrive in this environment, companies must balance cost efficiency with innovation, service quality, and environmental responsibility.

For exporters and manufacturers in particular, success will depend on strategic adaptation. Focusing on high-growth markets like Asia-Pacific, the Middle East, and Africa — where water infrastructure investment is booming — can provide long-term stability. Building technical partnerships with engineering firms and offering turnkey valve solutions, rather than individual products, can enhance competitiveness in large-scale tenders.

Additionally, continuous research and development are essential to maintaining technological leadership. Developing proprietary technologies such as low-torque actuators, self-cleaning valves, and AI-enabled monitoring systems can help companies differentiate themselves in an increasingly crowded global marketplace.

Conclusion

The relationship between global water treatment expansion and valve demand is clear and mutually reinforcing. As the world invests in cleaner, smarter, and more efficient water systems, the valve industry benefits from a steady stream of new opportunities — both in volume and in technological advancement. Valves are evolving from simple mechanical devices into intelligent, networked components that support digital water management and sustainability goals.

For valve manufacturers and exporters, this transformation signals a new era of growth — one where innovation, quality, and adaptability determine long-term success. By aligning with global water treatment trends and embracing intelligent, eco-conscious design, valve suppliers can secure a central role in shaping the future of sustainable water infrastructure worldwide.